The buzz around autonomous cars has brought a surge of excitement—and speculation—to the stock market, with investors eyeing AI-driven companies in hopes of capitalizing on the next big transportation revolution. As breakthroughs in AI, machine learning, and sensor technology bring us closer to the reality of self-driving vehicles, companies in this sector are seeing their stock values soar. But with all the excitement, it’s essential to weigh the hype against the realities and challenges that autonomous vehicle (AV) companies still face.

The cost and implementation of AI driven cars isn’t a one shoe fits all approach, there are rules of the road and safety of the public that needs to be respected before trusting these vehicles and not to mention the cost of making these chips for AI in the first place isn’t free.

Despite the excitement, there are still significant hurdles facing AV technology. Full autonomy—especially in complex urban environments—remains a technical challenge. AI must handle countless unpredictable situations, like sudden weather changes, construction zones, or erratic human drivers, with complete safety. Developing systems that can respond with near-human intuition is a challenge that AI has yet to fully solve.

AVs face an uphill battle in terms of regulatory approval. Governments worldwide are cautious, requiring extensive safety testing and clear accountability frameworks before allowing widespread deployment. Regulatory hurdles can slow down the commercialization of AVs, making the timeline for profitability longer than some investors may expect.

However people love to speculate the next new start up company to be built for just Autonomous Cars and put all their chips and marbles in jsut that specific company. For instance Telsa, BYD, or a brand new unknown company making waves.

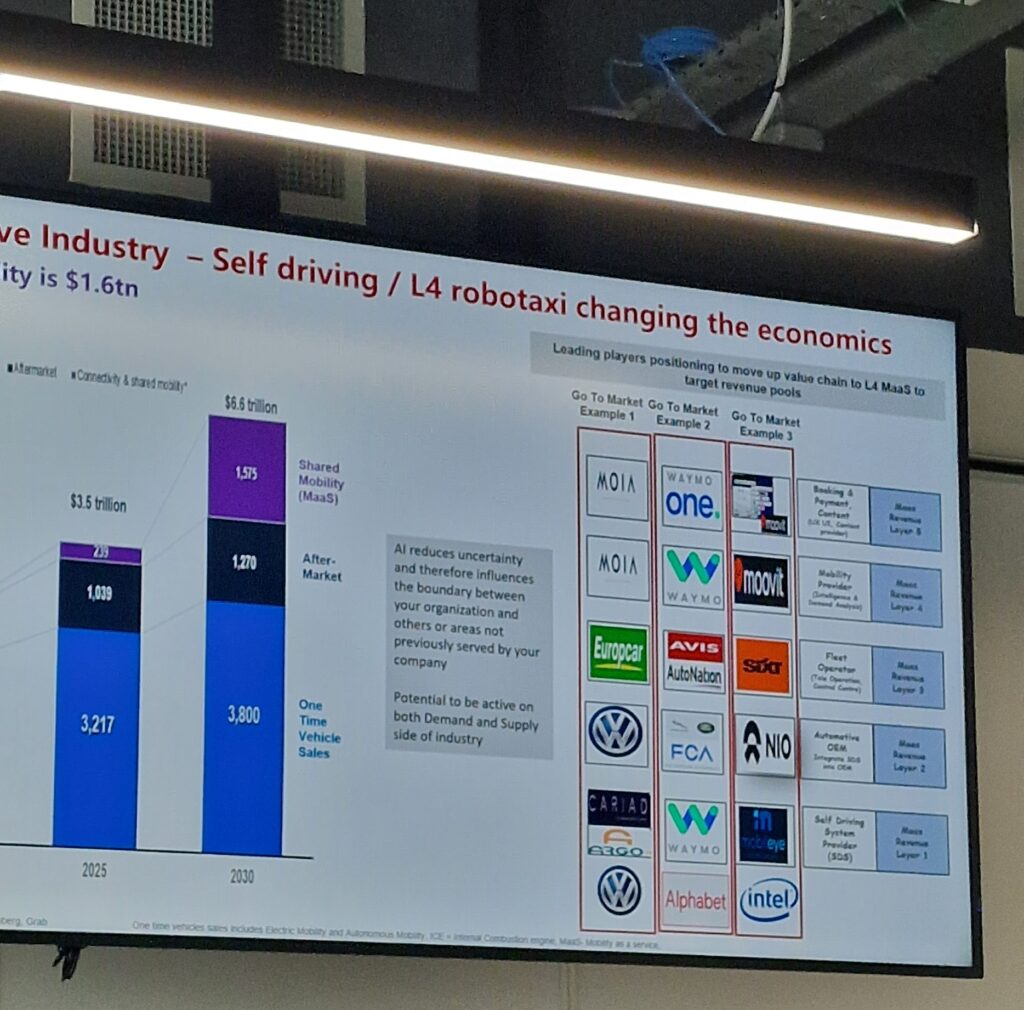

In fact even i would love to have the inside scoop and be able to tell my readers ‘company A’ or ‘company B’ shares is the gold mine and cheap but the matter of fact is these AI self driving companies would rather buy an exisiting company than developing their own, it is more pratical and easier.

Also AI acts + Av acts needs to lessen and turn down a notch before investing becomes a lucrative option for stock traders or investors. Which at this rate may be in 5 to 7+ years according to profession industry researchers opinon.

However i do have projections and an image to hint all the traders and investors in the right direction. Obtained and captured in a secret industry tech conference hehe! By the way keep an eye out on the insurance companies ;p !

For now, AV stocks continue to be a dynamic investment space where savvy investors see potential but must stay vigilant. Autonomous vehicle technology is advancing, but with a long road to full autonomy, patience will be a prerequisite for those hoping to see AV stocks yield strong returns.